Enhanced Efficiency Through Seamless Commissions and Yardi Voyager Integration

Transparency in CRE commission management is essential for building trust and ensuring fairness within any organization. It provides visibility into the calculation, distribution and payment of commissions.

Integrating commission software with property management systems takes transparency to the next level. Such integration ensures that commission calculations are based on accurate, real-time data. It also allows for seamless tracking of transactions and payments, providing a comprehensive view of financial operations.

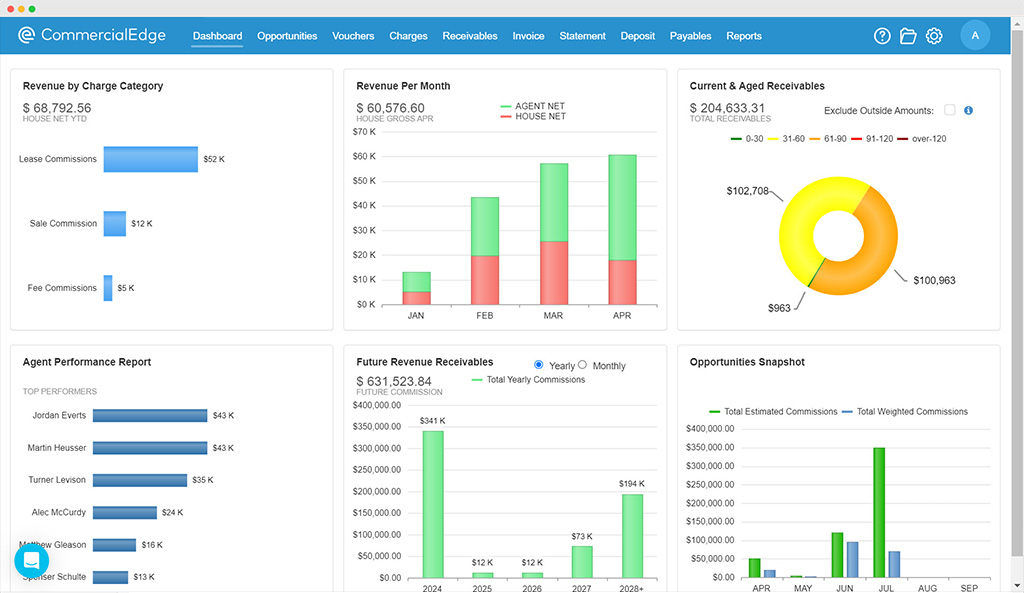

Commissions, part of the CommercialEdge suite for CRE, is a commission-tracking software and back-office solution designed to streamline financial processes for brokerages and brokerage divisions of full-service companies. It automates the tracking of invoices, monitors due dates and facilitates the configuration of complex commission rules while supporting cash, accrual and – hybrid-based accounting. The platform integrates seamlessly with Yardi Voyager and Breeze Premier, the company’s property management and accounting software systems.

The Commissions and Voyager integration is designed to enhance financial operations by eliminating manual efforts and synchronizing data across platforms. The integration enables full-service companies to manage their financials in one connected system, eliminating the need for multiple third-party platforms across different departments. By having everything within a single environment, companies can benefit from consistent client data and simplified reporting.

Flexible, Automated Workflows with Real-Time Data Synchronization

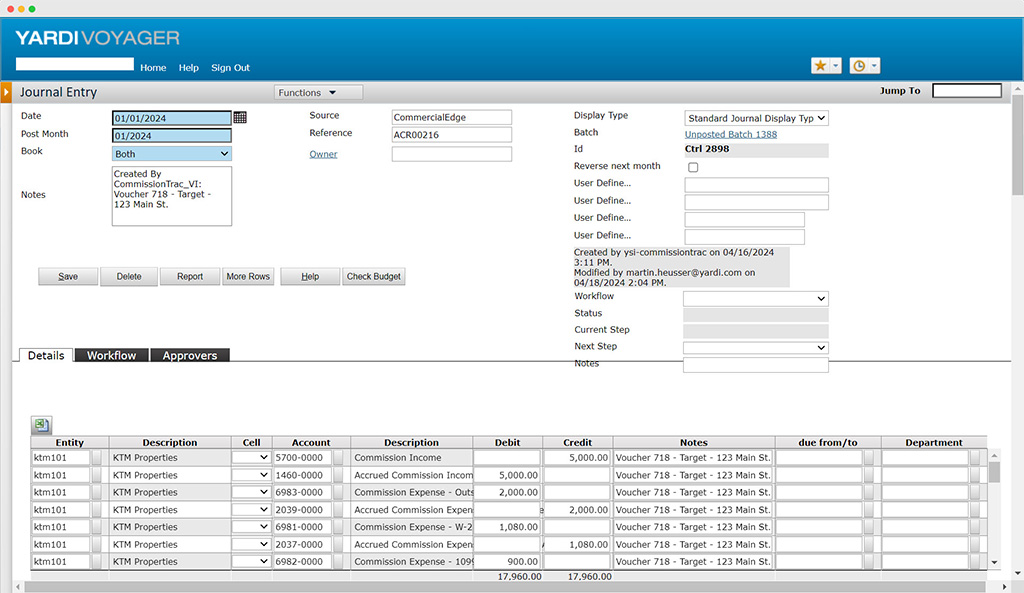

The workflow begins with a deal executed in Yardi Deal Manager, which then becomes a voucher in Commissions. The voucher contains all critical deal information, including billing and agent details. As a deal is recorded within Commissions, corresponding transactions are created in Voyager. The real-time data synchronization between the platforms significantly reduces manual data entry and potential errors. Accounting entries, charges, receipts and payables are generated automatically, streamlining the entire process from deal execution to agent payment.

Commissions and Voyager Integration Points:

- Journal Entries: All accrued income and expenses are recorded at the beginning of executing a deal.

- Charges Creation: As the life of the deal progresses, charges are created as invoices become due.

- Receipts Recording: Upon receiving payment from landlords, tenants or brokers, the system records a deposit, creating receipts in Voyager.

- Agent Payment: After receiving payments, agent payments are then processed, creating payables in Voyager.

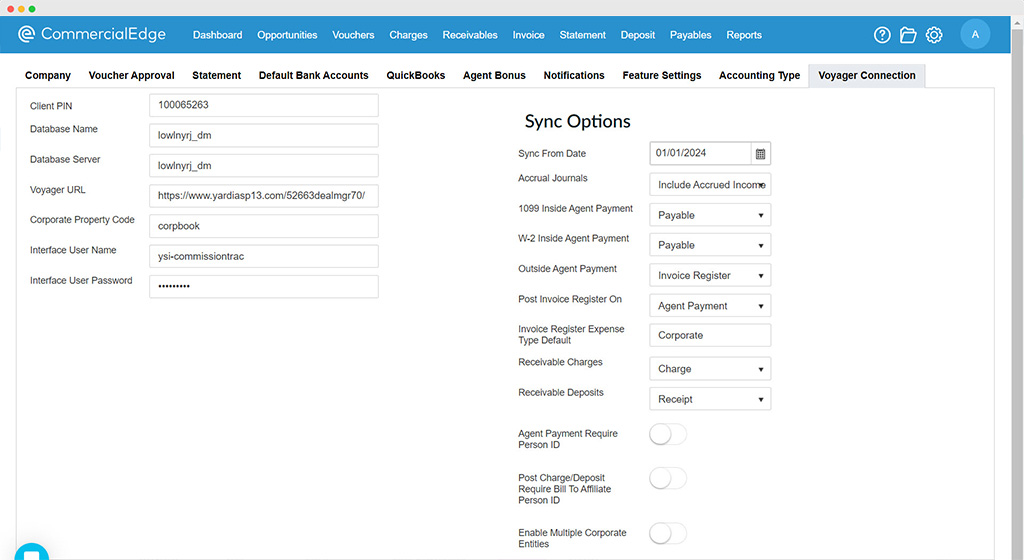

The integration allows clients to choose what gets synced, from journal entries to charges and agent payments, ensuring that transactions created and sent to Voyager align with their specific needs.

A critical part of the integration involves mapping charge categories in Commissions to general ledger accounts in the client’s Voyager environment. This mapping ensures accurate financial reporting and transaction management within Voyager.

The customization and mapping options provide more flexibility and control to clients, allowing them to decide which transactions to create and how to manage their accounting entries more effectively.

Another significant aspect of this integration is its support for accrual accounting, a requirement for GAAP (Generally Accepted Accounting Principles) compliance in the U.S. This is particularly important for publicly traded companies, which must adhere to these accounting principles. The system allows for the accrual of invoices and commissions before cash transactions occur, providing a more accurate picture of the company’s financial health and obligations. This preemptive financial recording and reporting capability is crucial for strategic planning, especially anticipating and managing cash flow.

Setting up the integration between Commissions and Voyager is simple and direct and can be completed quickly, ensuring a smooth transition to a more integrated and automated workflow.

Designed with the back-office accounting team in mind, the integration automates complex and time-consuming tasks, from the creation of financial entries to the management of agent payments, freeing up valuable resources that can be redirected toward more strategic activities.

The bidirectional relationship between Commissions and Voyager enhances the system’s flexibility and utility. This two-way integration allows for a more dynamic interaction between the two systems, enabling users to leverage the strengths of each platform depending on their specific needs.

Conclusions

The Commissions and Voyager integration allows companies to streamline their workflows across different departments through comprehensive, automated and real-time solutions for deal management, accounting entries and agent payments.

The integration simplifies the financial process and minimizes the risk of errors, ensures compliance with accounting standards, enhances operational efficiency and provides insights into the company’s financial health.

More Articles You Might Like

BOMA Advocacy Report: The Impact of Transfer Taxes on Commercial Real Estate

The BOMA Advocacy Report on Transfer Taxes examines the effects of real estate transfer taxes (RETTs) on commercial properties across the U.S.

Understanding Stacking Plans and Their Importance in Commercial Real Estate

Stacking plans are valuable tools in CRE leasing and asset management, especially with a dedicated solution that automates their creation.

Manufacturing Growth Set to Fuel Industrial Space Demand

The manufacturing sector is expected to remain a key driver of industrial development, though not without challenges.