Key Tools for Simplifying Brokerage and Financial Management

Building on its reputation as a property management software solution, Yardi has consistently expanded its commercial real estate solution stack. Today, it encompasses a wide range of offerings, including brokerage commissions and consolidated financial management for full-service real estate firms.

For real estate companies with a leasing or brokerage division, commission management can be a complex, multistage accounting process that consumes a lot of staff time and resources. If you’re involved in brokerage and consolidated financial activities and looking to make these processes more straightforward and efficient, consider combining those operations with property management on one platform.

Inefficiencies With Separate Platforms

Historically, property management and brokerage operations have been performed on separate operating systems. This scenario can produce several inefficiencies. For example, calculating complex agent commissions for each deal requires much manual data entry into the property management and accounting system, with agents moving across split plan tiers and different tier structures within a deal.

Invoice processing and commission splits often are entered into the property management and accounting system long after the fact. Yardi clients have reported that up to 25% of commissions they calculated manually were incorrect.

Additional complexities include:

- Commission variations due to the type of transaction, such as a lease, sale or fee.

- Brokers’ custom commission structuring can vary by region.

- Cash vs. accrual accounting methods.

- Commission invoicing and receipt.

- Distribution calculations and payments to agents.

Executing all these operations accurately and keeping detailed accounting records is crucial not just for staying compliant with tax regulations and monitoring a company’s financial performance but also for providing transparency to the agents.

Handling property management and broker activities separately also prevents executives from obtaining a complete, real-time financial picture of what’s happening across the business.

When a broker transaction generates an invoice, for example, that invoice wouldn’t be visible for months until the tenant moved into the building. An open receivables report would show upcoming property management fees and rent payments to be collected from tenants but not brokerage activity or what agents were owed from that income.

CommercialEdge Commissions: Simple and Sophisticated

Is it possible to manage property management and brokerage activities from a single platform? One that synchronizes accounting and property management to deliver a consolidated financial image more accurately and with less staff labor? Yes, and that is where CommercialEdge Commissions comes in.

The CRE solution, part of CommercialEdge and fully integrated with Voyager Commercial and Yardi Elevate, connects agents, operations and accounting processes by centralizing all deal data, documents, invoice dates and commission splits. It tracks invoices, monitors due dates and automates even the most complex commission distributions.

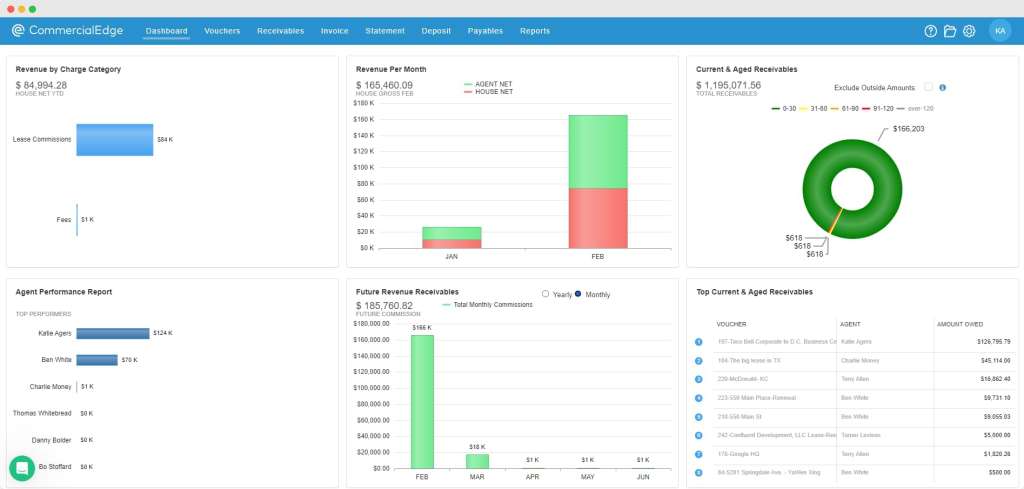

CommercialEdge Commissions provides complete commission and back-office solutions for brokerages and leasing teams by streamlining operations, elevating productivity and boosting revenue with automated workflows powered by real-time business analytics.

Equally important, Commissions brings property management, brokerage and commission generation into one system. All activity is recorded in Voyager in real-time and can be configured to support cash or accrual basis transactions.

This centralization is much more efficient than tracking brokerage transactions with spreadsheets outside Voyager, then repeating those transactions to keep Voyager up to date. There is no more unnecessary manual data entry and manual calculation of complex commission splits among agents and brokerages.

Yardi clients find Commissions simple enough for busy brokers yet sophisticated enough for small, medium or large enterprises, as Susan Olinsky, senior VP of finance for Colliers Philadelphia, notes:

“CommercialEdge Commissions has automated what we were doing manually, which was prone to error. It can handle all transaction types, so to me, that’s the highest recommendation you can get — that it can handle your business needs.”

Susan Olinsky, Senior VP, Finance, Colliers Philadelphia

Managers can view commissions, rent, property management, receivables and more and gain a real-time, consolidated view of the enterprise in Voyager, with the added convenience of being able to pull the data into Yardi Forecast Manager. Commissions can also accommodate the accrual accounting favored by most brokerages.

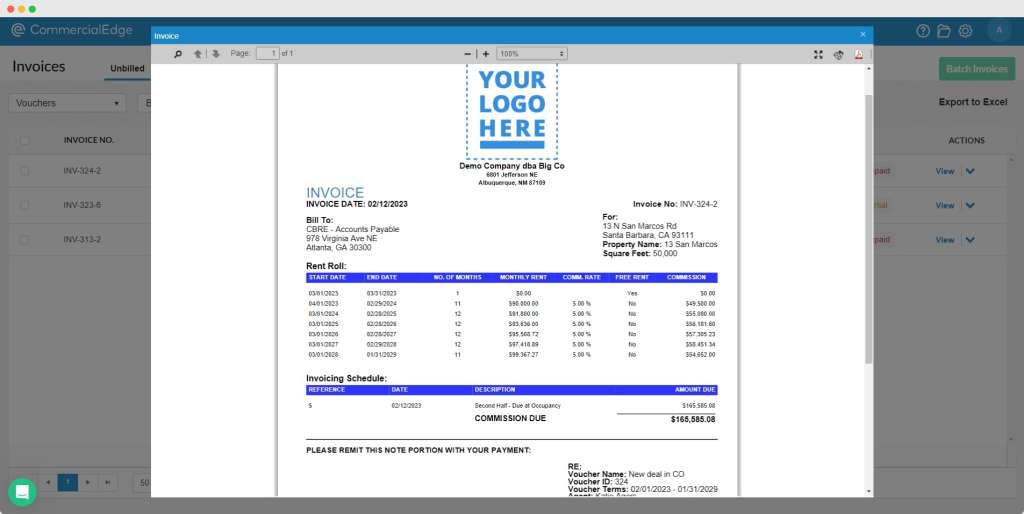

CommercialEdge Commissions eliminates siloed data, provides a deal data repository, generates custom-branded invoices, calculates broker distributions, provides transparency to agents on their earnings and commission calculations and supports accrual, cash and hybrid accounting methods. The complete integration with Voyager provides consolidated financials for a real-time understanding of business health and broker performance.

Conclusions

Real estate business operators are discovering they can standardize operations on a single connected solution, with Voyager and Elevate on the property and asset management platforms and CommercialEdge for revenue lifecycle and brokerage operations.

With tools for marketing, listings and syndication, pipeline and deal management, legal and research and market data, the CRE software is a one-stop solution that saves time, costs and staff labor.

More Articles You Might Like

Sales Activity Remains Slow as Discounted Office Sales Jump to 30%

As of May this year, there have been 600 office sales, an increasing number of which are being sold at discounts.

The Benefits of CommercialEdge Commissions for Brokers

The commission management solution simplifies complex processes, enhances transparency and boosts operational efficiency.

Industrial Vacancies Normalize as High Inflation and Costs Slow Demand

The U.S. industrial vacancy rate was 5.2% at the end of April, unchanged month-over-month as demand for space has been moderating.